I won’t go into detail about Dave Ramsey, I’m sure you already know who he is.

I’m sure you also know about his 7 Baby Steps, right?

While going through the 7 Baby Steps (or any financial journey) one of the first things you need to do is create a budget or spending plan.

But this is where things can get a bit confusing – you’ll probably have some questions like: How much should you be spending in each category? What are the different budget categories?!

Dave Ramsey has some budget percentages that you can apply to your budget to make things easier. You can use these budgeting percentages to help divide (divvy) up your paycheck in a way that helps you pay all of your bills and save money.

In this post, we’ll talk about the specific budget categories that Dave Ramsey recommends, and how much he recommends spending in each category.

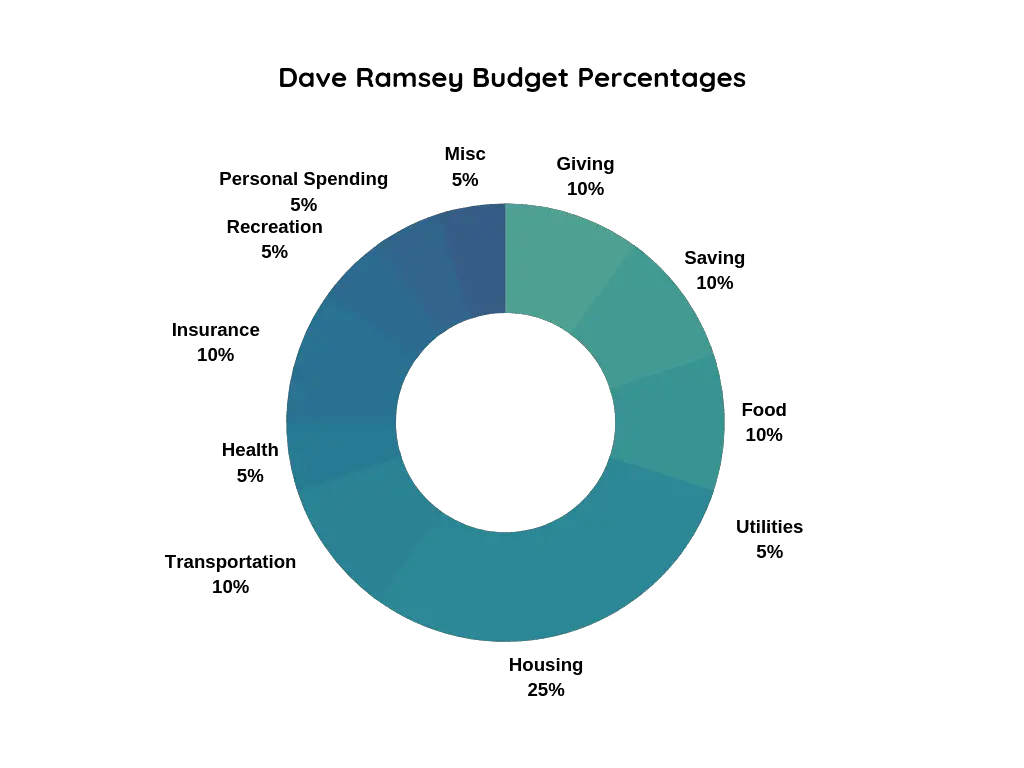

Dave Ramsey Budget Percentages

If you’re just starting out with budgeting, these budgeting percentages recommended by Dave Ramsey are a great starting point.

**Just a few notes, these percentages are meant to applied to your after-tax money (but before any 401(k) contributions and health insurance payments).

Here are the category recommendations and percentages:

- Giving: 10%

- Saving: 10%

- Food: 10-15%

- Utilities: 5-10%

- Housing: 25%

- Transportation: 10%

- Health: 5-10%

- Insurance: 10-25%

- Recreation: 5-10%

- Personal Spending: 5-10%

- Misc.: 5-10%

Now this might be a lot to digest, and some of the categories might not make any sense to you, so we’re gonna go through each one (I told you I got you).

Dave Ramsey Recommended Budget Categories

Giving – 10%

Dave Ramsey is big on giving, specifically tithing. So it makes sense that he makes room in the budget for giving.

Dave Ramsey recommends giving at least 10% of your income.

Now, I think giving is a great thing (I think everyone should give some amount of money to charity regularly), BUT, if you’re in debt, I don’t think you should be giving money to charity or tithing. I think you should focus on paying off your debt.

Saving -10%

This savings section is for things like big purchases and saving up for your emergency fund, and this category is also used for investing and building wealth.

Dave recommends saving a starter emergency fund then paying off debt, and then going back and saving up 3-6 months of expenses.

I think 10% is a good start, but I think you should try and get to that 3-6 months of expenses as fast as you can (so 10% might not be enough).

Food – 10-15%

Whew, only 10-15% of your budget for food.

This would be pretty tough for me honestly. Especially since this is both eating out and regular groceries.

To get to 10-15%, you’ll most likely have to stop eating out altogether, you will have to carefully meal plan, and you will most likely use coupons!

But if you are laser-focused on savings as much as you can, getting out of debt, and investing as much as you can, then keeping your food budget to 10-15% of your budget is a great guideline.

Utilities – 5-10%

These are utilities for your home, including gas, water, electricity, etc.

You could also add internet and your phone into this category also.

Housing – 25%

Housing will most likely be everyone’s biggest expense. For this particular category, it’s not just rent / your mortgage, it’s also any HOA fees, PMI, and taxes.

Dave recommends spending no more than 25% of your expenses.

Let’s be realistic. It’s probably not possible for a lot of people to spend less than 25% on housing – especially if you live in a high cost of living area or if you make minimum wage (or less).

But remember, these are just guidelines.

Transportation – 10%

This category is for any transportation costs, if it’s gas, oil changes, even bus fare – it goes here.

Don’t forget about car insurance!

10% might be impossible for some (if you have a car loan), but you should try and get these expenses as low as you can.

Health – 5-10%

This part is anything you need for your health, like aspirin, cold medicine, etc.

I think 5-10% might be too much money, I’d watch this category closely, and combine it with another category.

Insurance – 10-25%

This insurance category is for all the insurances! Health insurance, life insurance, homeowners insurance, etc.

Recreation – 5-10%

This category is for the fun stuff, this can be date nights, going out to eat, maybe catching a movie (or two), or even play at Uptown Aces Casino.

You can also add in things like Netflix or Spotify subscriptions.

Personal Spending – 5-10%

This is for personal purchases that aren’t necessary (could also be for more recreation).

These expenses can be some ice cream, new clothes (that you don’t need), etc. Just the fun extras that aren’t totally necessary.

Misc – 5-10%

Now this category is for everything else. Sometimes budgets just don’t cover everything perfectly, you may overestimate something, or an expense might come up that you weren’t expecting – that’s what this category is.

Consider it a buffer. Everyone needs some wiggle room.

Does the Dave Ramsey budget work? Is it even realistic?

The simple answer is yes, the Dave Ramsey budget can work and HAS worked for a lot of people.

But it may not be realistic for YOU.

With some categories, it just may not be 100% realistic for you to stay within the budget percentages.

For example, if you live in a high cost of living area like New York or California, it may be impossible for you to keep your housing as just 25% of your overall budget.

So use these budget percentages as general guidelines to help create a budget that works for you.

Dave Ramsey Budget Applied

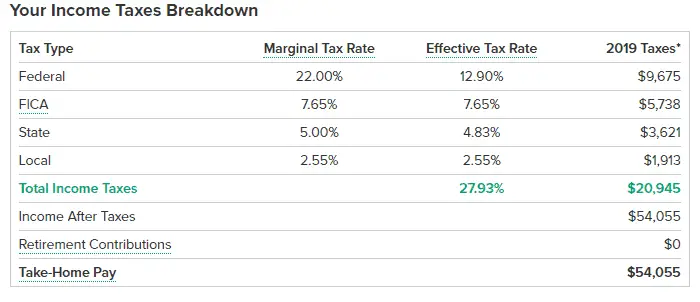

Want to see this budget applied to some real numbers? We’ll take my husband’s salary of $75,000 and apply it. First we must figure out how much the salary is after taxes, I used the SmartAsset calculator to help me.

So the after tax amount is $54,055, monthly this would be about $4504. For this chart I rounded to the nearest dollar.

| Category | Monthly Spending | Yearly Spending |

| Giving (10%) | $450 | $5,400 |

| Saving (10%) | $450 | $5,400 |

| Food (10%) | $450 | $5,400 |

| Utilities (5%) | $225 | $2,700 |

| Housing (25%) | $1,126 | $13,512 |

| Transportation (10%) | $450 | $5,400 |

| Health (5%) | $225 | $2,700 |

| Insurance (10%) | $450 | $5,400 |

| Recreation (5%) | $225 | $2,700 |

| Personal Spending (5%) | $225 | $2,700 |

| Misc. (5%) | $225 | $2,700 |

| Total: | $4,501 | $54,012 |

How does my personal budget compare to the Dave Ramsey Budget?

Let’s compare the Dave Ramsey budget percentages to our own budget percetnages:

| Category | Dave Ramsey Budget Percentages | Brittney’s Budget Percentages |

| Giving | 10% | 0% |

| Saving | 10% | 20% |

| Food | 10% | 10% |

| Utilities | 5% | 5% |

| Housing | 25% | 25% |

| Transportation | 10% | 5% |

| Health | 5% | 5% |

| Insurance | 10% | 5% |

| Recreation | 5% | 15% |

| Personal Spending | 5% | 5% |

| Misc. | 5% | 5% |

Well our budget is pretty different from the Dave Ramsey budget!

Let’s do a quick analysis of our different categories and the spending:

- Giving: Ooof, I’m kind of bummed that we don’t do any organized giving. I’d like to change this!

- Saving: I love that we’re saving 20% of our overall income, but I’d like to also bump this up.

- Food: I was surprised that we only spend 10% on groceries. NICE.

- Utilities: Same as the Dave Ramsey Budget

- Housing: Same as the Dave Ramsey Budget! I was surprised by this one too, I thought our percentage would be lower but when you add in the HOA and taxes, it does equal about 25% of our income.

- Transportation: This one is lower because we don’t do much driving (we work from home), and we paid for the car in cash.

- Health: Same as the Dave Ramsey Budget

- Insurance: A bit lower than the Dave Ramsey budget.

- Recreation: This recreation includes eating out – which we do a LOT of. 🙂

- Personal Spending: Same as the Dave Ramsey Budget

- Misc: Same as the Dave Ramsey Budget

Other Budgeting Styles to Consider

If the Dave Ramsey budget isn’t something that works for you, there are other budgeting styles you could try!

50/30/20

If the Dave Ramsey budget categories are a bit too complicated or restrictive, you could use the 50/30/20 rule.

It’s where you spend 50% of your income on your needs, 30% of your needs on wants, and 20% gets saved / invested.

If you’d like to learn more about 50/30/20 budgeting, we have a post that explains it.

Zero-Based Budget

A zero-based budget is where each dollar is given a category. Basically your income minus your expenses will be zero.

We personally use a modified version of this budget.

Cash Envelope Budgeting

Cash Envelope budgeting is an interesting one. It’s where you categorize your budget using envelopes.

You have an envelope and set amount for each budget category, and you fill the envelopes with that amount of money (cash!) so when the money runs out you either stop spending or take the money from another envelope.

If you’re interested in learning more, we have a whole guide on cash envelope budgeting.

Budget By Paycheck

The budget by paycheck method is where you create a budget each time you get a paycheck.

My friend Marissa is a pro at this, and she has a whole post explaining budgeting by paycheck.

The Perfect Household Budget

As you can see, there are tons of different ways you can budget your money. There’s no one-size-fits-all that works for every household.

The best budget is the one that you can stick to that helps you reach your financial goals.

Try a few different approaches and see what works for you!

How to Start Budgeting

If you’d like a basic guide on how to set up a budget, you can check out our post.

Final Thoughts

So what do you think of these budget percentages? Do they work for you? What would you change?

Also, what budgeting method do you personally use?